Policy & regulatory development to catalyse larger uptake of private equity and private debt investments by pension funds in SADC.

The primary objective of this study was to review the status quo, understand opportunities and challenges and make recommendations for policy and regulatory development to enable the benefit from the returns and diversification of pension funds in Southern Africa.

We commissioned this research in partnership with the Southern African Venture Capital and Private Equity Association (SAVCA), and the findings presented are drawn from questionnaires conducted with 52 funds in eight countries including Botswana, Eswatini, Lesotho, Mozambique, Namibia, South Africa, Zambia, and Zimbabwe. These funds represent about $160 billion in assets under management (AUM), which translates to 30% coverage of the full AUM of funds in the region. This was complemented by interviews with regulators, pension fund leaders and other experts to collect more specific data and to contextualise the findings.

Overall, this study paints a picture of a very diverse set of markets in the region with unique challenges, and we aim to strike a balance between providing regional insights with specific issues and opportunities in each market for positive reforms.

The African continent presents a massive investment opportunity for investors to advance climate solutions in the coming decade, however, a set of barriers to finance have stifled requisite investment to date. In this new report, in collaboration with Climate Finance Innovation for Africa and Climate Policy Initiative, we provide a framework for how innovation in financing structures can leverage strategic deployment of public capital to ‘crowd-in’ private investment at levels not yet seen.

This paper focuses primarily on climate mitigation, which represents the largest investment opportunity for private investors. We refer audiences focused specifically on adaptation to the work done by the Global Center on Adaptation and Climate Policy Initiative on Financial Innovation for Climate Adaptation in Africa.

We engaged Lion’s Head Global Partners to conduct a study on Private Debt markets in Africa. While keeping a pan-African perspective, the study focussed on Nigeria, Kenya, Ghana, and Morocco as markets of strategic importance. South Africa was used as a reference market, given the development of the financial sector and the size and scale of the South African institutional investor base.

In addition to desk research and data analysis, the outputs, analysis, and recommendations were driven by stakeholder consultations, workshops, and interviews to both reflect individual positions, but also generate buy-in from stakeholders.

The insights from the study will support FSD Africa’s overarching strategic goal to mobilise long-term finance in local currency to support Africa’s development priorities and inform our transaction support, regulatory initiatives and knowledge and capacity-building engagements under its Africa Private Equity and Private Debt programme. The study will also benefit stakeholders including institutional investors, borrowers, regulators and policymakers, who seek to improve the enabling environment.

Just as in technology and finance industries around the world, fintech companies in Africa are grappling with a severe under-representation of women in leadership roles and throughout their businesses. When compiling the data in the 2017 Fintech Talent Africa report, Digital Frontiers Institute (DFI) made gender balance a particular focus of the research, knowing that this is a significant problem in the industry.

The findings of the report validated this belief. More than 400 industry leaders and professionals responded to the survey and of these, only 12.5% were women. The gender gap was reflected again in the data they reported: respondents indicated that the teams they lead are made up of approximately 39% women, while senior or executive teams are made up of 43% women. This data highlights that there is still a way to go in order to achieve gender parity.

To learn more about addressing the gender gap in fintech, access the full blog via this link.,

Building healthy credit markets in Africa by 2026

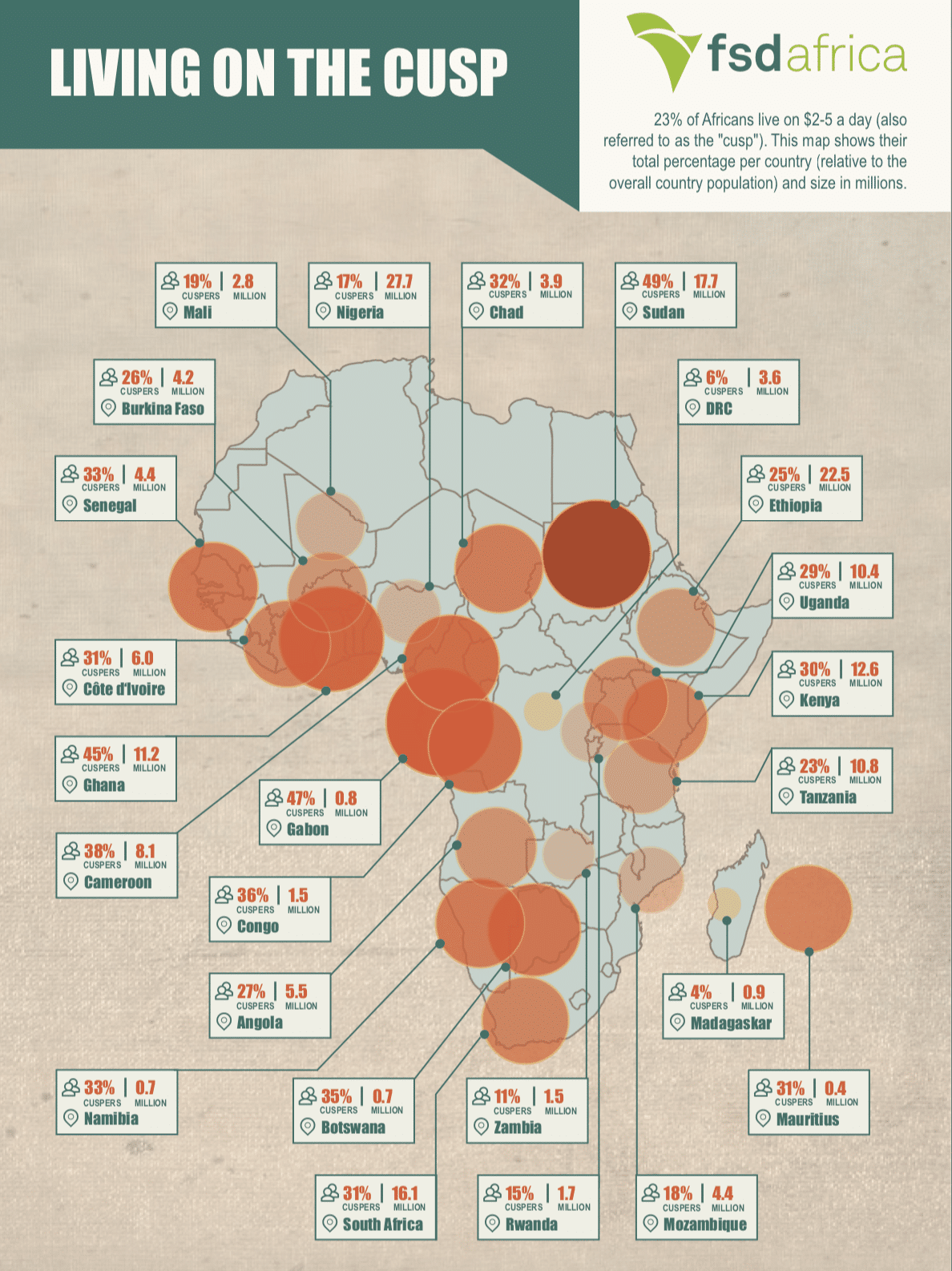

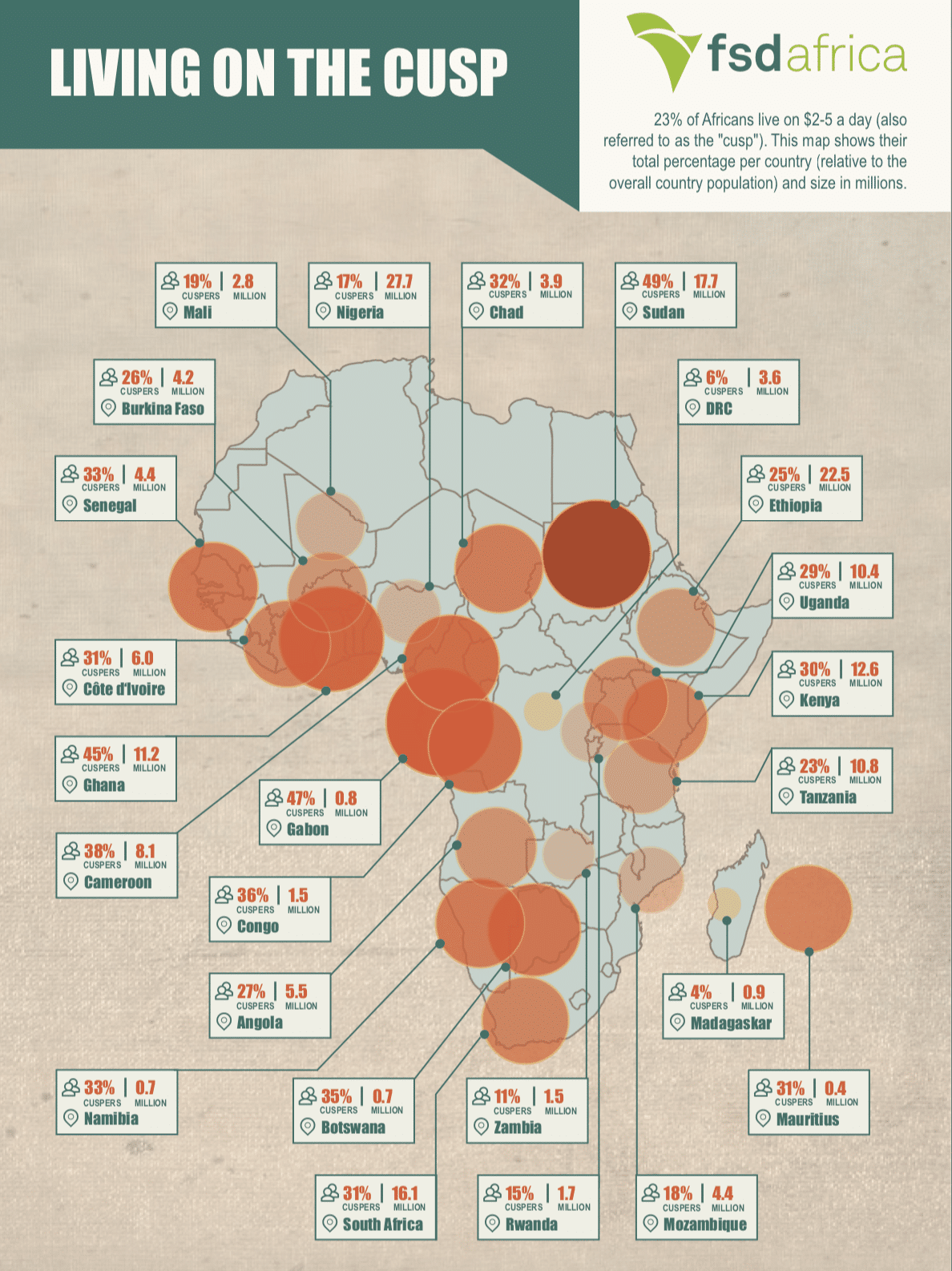

African economies are currently undergoing dramatic changes, including a changing consumer base. Absolute poverty is reducing as a new class of consumer—the cusp group—emerges. This group (we call “cuspers”), which now accounts for 23% of sub-Saharan Africa’s population, covers a segment of active earners getting by on $2-$5 per day and straddling the formal and informal worlds. For this group, healthy credit markets could expand opportunity and enable upward mobility, helping to build a true middle class. But, for this to happen, credit needs to expand and to do so in healthy ways.

In the Credit on the Cusp project, we look at the experience of cusp group borrowers and the lenders who serve them in three distinctive markets—South Africa, Ghana, and Kenya—to better understand what healthy credit market development would mean for this group. We explore some ways donors and policymakers can help build credit marable upward mobility for Africa’s cuspers

Overview

Across Africa, the residential investment opportunity is increasingly driving conversations about economic growth. While the definition of who is middle class and how many such households there are continue, the fact of Africa’s rising population and rapid urbanisation is palpable in its cities where the inadequate housing conditions of the majority are obvious.

For every problem, there is an opportunity for a solution, and in increasingly creative ways, this is what Africa’s housing investors are finding.

Most investment funds currently active were initiated when the African growth trajectory was on an upward curve. The past year has been challenging, however. Still among the fastest growing continents, Africa has seen its growth and development prospects seriously challenged by global economic pressures, the commodities downturn and the slowing Chinese economy. Where the prospects of oil and gas discoveries dominated the news five years ago, in 2016 it is their loss in value ng governments reconsider their economic development strategies. The key challenge in this environment, is economic diversification. Can housing contribute towards that opportunity?

Governments can contribute significantly to a developer’s ability to deliver affordable housing at scale, by paying attention to the rough spots along the housing value chain: the availability of land, its servicing (especially water and electricity), and its registration;

the availability of domestic building materials and a functioning construction sector; the time it takes to get administrative approvals for the building process, and the cost of such approvals; the taxation, finance and macro-economic framework; and the functioning of the labour market, among so many other factors.

Read full report from”http://housingfinanceafrica.org”>CAHF here.,

Imagine Johannesburg, with its highways, traffic signals, shopping malls, chain restaurants and supermarkets. Now picture Nakuru, a small Kenyan town, filled with old, narrow roads clogged with tuk-tuks and street vendors, pushing themselves shoe-less into the traffic and hauling heavy hand-drawn carts stacked with goods that will fill the small, owner-operated shops and kiosks, 10 on every block. If you were getting by on $5 per day, where would you rather live?

Reproduced from CGAP

Click here to read more,

The past five years or so have seen a number of exuberant studies and predictions that Africa’s rapid growth was creating a new middle class. This new group of consumers, it was argued, would become an engine of domestic demand, reducing reliance on exports and sustaining economic growth in the same way as they have in China. There were even predictions that this new middle class would transform governance and politics. This was the hopeful and optimistic story of “Africa Rising.”

Click here to read more